Chinese consumers will continue to spend more on luxury goods but a different population group will drive this activity, according to a new report by Swiss private banking group

Julius Baer’s annual Lifestyle Index, now in its eighth year, tracks the cost of luxury living and wealth creation across Asia. As the world’s growth engine it has become the barometer for a wealth industry asking: If China’s economy continues to slow, is waning appetite for luxury consumption far behind?

The report hints that demand will slow, but in 2018 the index has logged its best yearly price growth on record -- rising 2.91 per cent for the year in US dollar terms -- indicating that the buying power of high net worth individuals in Asia is not on the wane just yet, but is shifting.

The report says Chinese consumers will continue to expand their spending in luxury goods but led by a different demographic from the past, namely, “the middle class, the millennial and the female consumer.”

The index tracks 22 items across 11 Asian hub cities and operates much like the Economist’s Big Mac Index. Not natural bedfellows on the spending spectrum, but they both measure the price point local economies will support for individual goods, and seen as mirroring the fortunes (or fate) of global GDP.

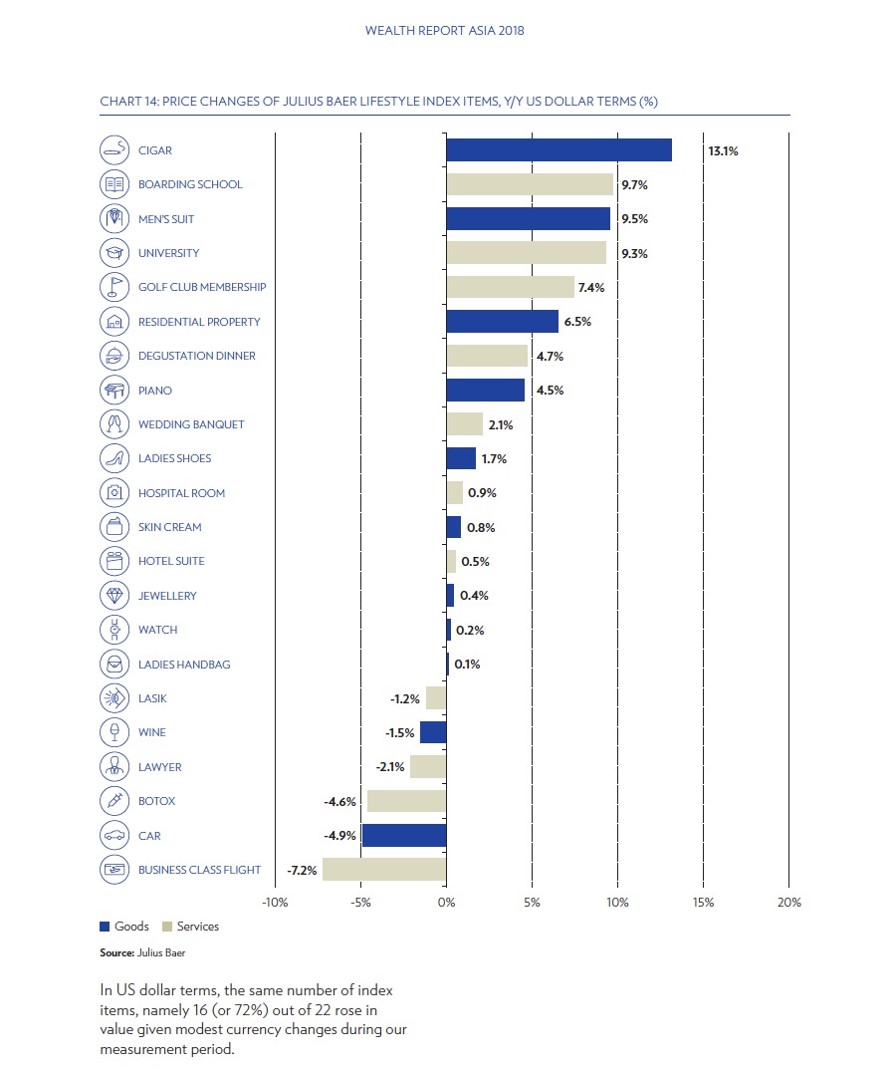

(The following charts price changes of key luxury goods/services items.)

What keeps spenders spending?

Research for 2018 shows several trends keeping luxury-spending active in the region, including governments boosting domestic consumption through tax incentives; luxury goods companies cooperating more on pricing; and the never-to-be underestimated power of scarcity to the luxury goods market. In local currency terms, prices of 16 of the 22 items tracked rose for the year.

Shanghai tipped Hong Kong to become Asia’s most expensive city and most expensive place for six of the index items – hospital accommodation, watches, ladies handbags, wine, jewellery and skin cream. At the opposite end, Kuala Lumpur remains Asia’s best value city. Seoul was the most expensive city for both male and female luxury goods.

Women bring their purchasing clout

Under the theme “Womenomics,” the bank says women now account for half of Chinese luxury spending, with their purchasing power on the rise across Asia as more women join senior management positions and become more financially astute.

Data shows that Asian women, particularly in Malaysia, Thailand and China, are increasingly becoming self-made millionaires and China’s female millennials are becoming major bankrollers of the luxury market at home and abroad, driven by online shopping convenience and financial support from family.

Women are also spending more on products that were traditionally in the male domain. Cars, which they increasingly see as a status symbol, account for the highest proportion of spending among affluent Chinese females.

Fine China

Within the region, China tops the luxury-spending list, with Chinese nationals accounting for more than 30 per cent of the spending in the luxury goods industry and for more than 70 per cent of its growth. That is up from just 2 per cent of spending in 2003.

While Asia’s wealthy consumers will continue a leading role growing the luxury goods market, “their tastes have evolved and matured,” the bank said. In the next decade, a growing proportion of them “will be younger (40 percent Gen-Z and milliennials), digitally connected, price-sensitive, socially conscious and female”.

Price parity between genders

In a “His & Hers” index added this year, the bank reports that women on balance pay more for comparative luxury goods than men across Asia. The report rolled in research from 2016 that looked at ecommerce sites of Saint Laurent, Valentino, Gucci, Dolce & Gabbana, Balmain and Alexander Wang, and found 17 instances of male and female versions of product at different prices, with women charged up to $1,000 more.

On average, it costs $2,158 more to purchase a “her” item relative to a “his” item. But that price difference comes down by $126 when “wrist accessories” are excluded, and this is largely down to one item – the Cartier Love Bracelet – seen as a must-have item among UHNW women in the region, retailing at around $48,000. There is an interesting story about its allure here.

Defending the “his her” price gulf, the report said “women are willing to pay more for fashion” and products made for women often “require more workmanship than men’s.” It also said “women in Asia are not purely preoccupied with the consumption of luxury goods and services,” and “proving their mettle at making investment decisions."

Where does this take consumer wealth in 2019?

Markets have taken a battering in the latter part of this year and observers see global luxury consumption inevitably slipping in 2019 as China slows and trade disputes between the US and China are only put on temporary hold.

Longer-term, however, the bank sees a positive outlook for the luxury market, with any shortfall made up by ranks of wealthy Chinese millennials and greater numbers of Asian women flexing their purchasing power.

(How China compares with other major nations when it comes to liking luxury goods/services.)